research

working papers

1. Inactive money balances and the persistence of bull markets

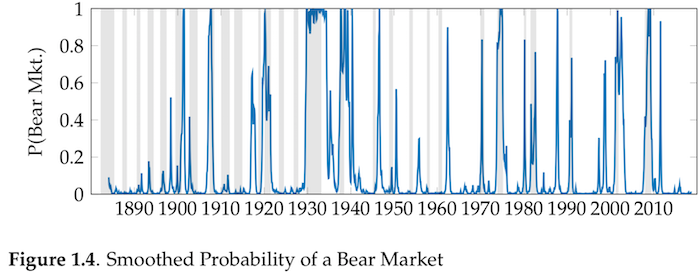

The traditional approach to financial theory assumes that any profitable speculation in financial markets will have stabilizing effects on prices. Speculation could only be destabilizing if investors, on average, bought high and sold low. Since this strategy would be unprofitable, speculation should dampen fluctuations as “arbitrageurs” bet against speculative bubbles. Despite the large body of theoretical and empirical work in favor of the idea that speculation has destabilizing effects on asset prices, the “traditional view” has still been used to argue that bank lending for the speculative purchase of assets will reduce price volatility. In this paper, I argue that financial intermediaries play a role in perpetuating periods of overvaluation through the extension of credit used for speculation. Using a Markov-switching vector autoregressive model with time-varying transition probabilities, I show that the expected duration of a “bull market” is dependent on the portfolio decisions of financial and nonfinancial sectors. As such, when the banking system lends against collateral, which is itself the object of speculation, asset price bubbles can persist, even when a growing share of investors believe that assets are overvalued.

The traditional approach to financial theory assumes that any profitable speculation in financial markets will have stabilizing effects on prices. Speculation could only be destabilizing if investors, on average, bought high and sold low. Since this strategy would be unprofitable, speculation should dampen fluctuations as “arbitrageurs” bet against speculative bubbles. Despite the large body of theoretical and empirical work in favor of the idea that speculation has destabilizing effects on asset prices, the “traditional view” has still been used to argue that bank lending for the speculative purchase of assets will reduce price volatility. In this paper, I argue that financial intermediaries play a role in perpetuating periods of overvaluation through the extension of credit used for speculation. Using a Markov-switching vector autoregressive model with time-varying transition probabilities, I show that the expected duration of a “bull market” is dependent on the portfolio decisions of financial and nonfinancial sectors. As such, when the banking system lends against collateral, which is itself the object of speculation, asset price bubbles can persist, even when a growing share of investors believe that assets are overvalued.

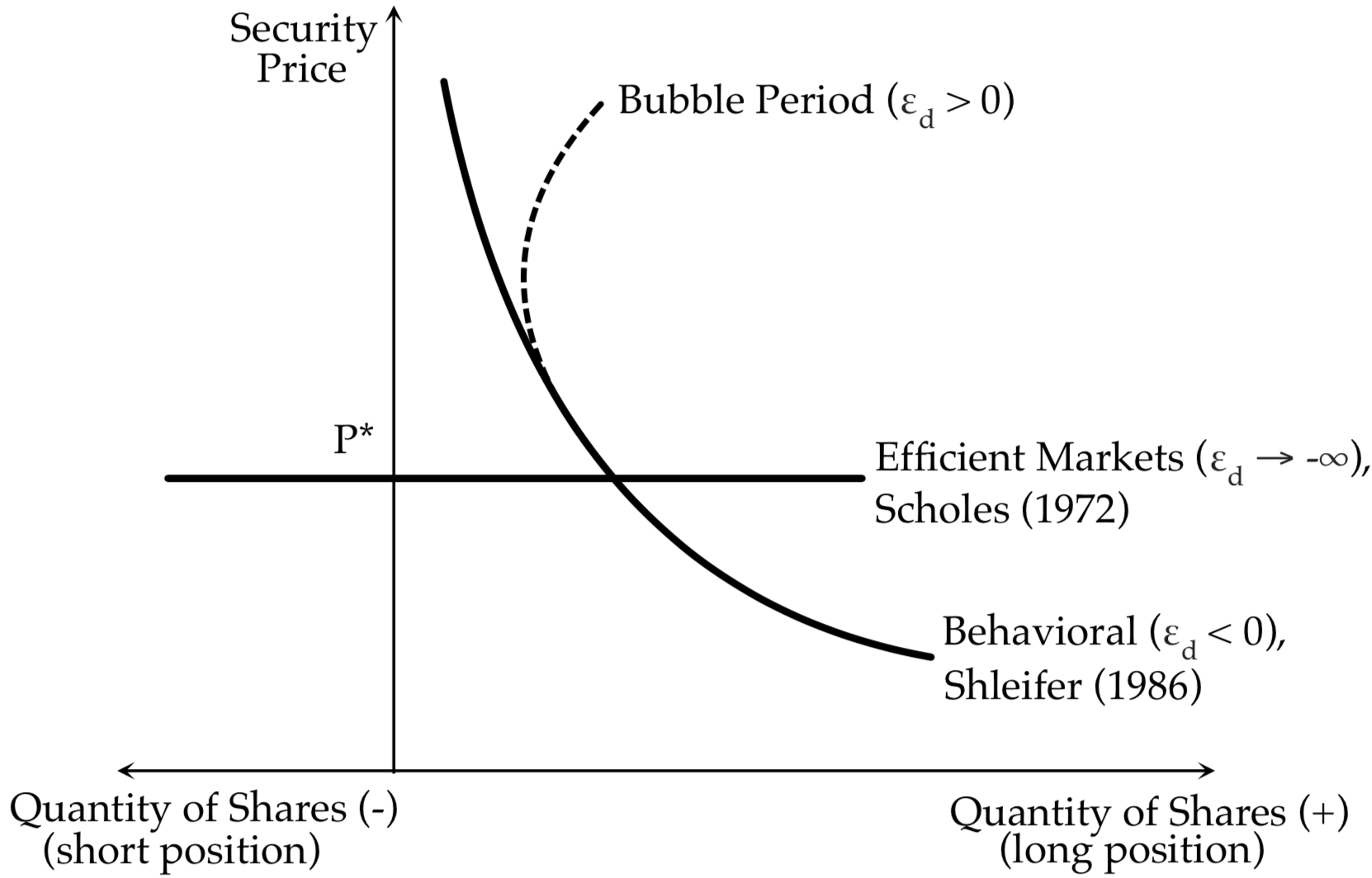

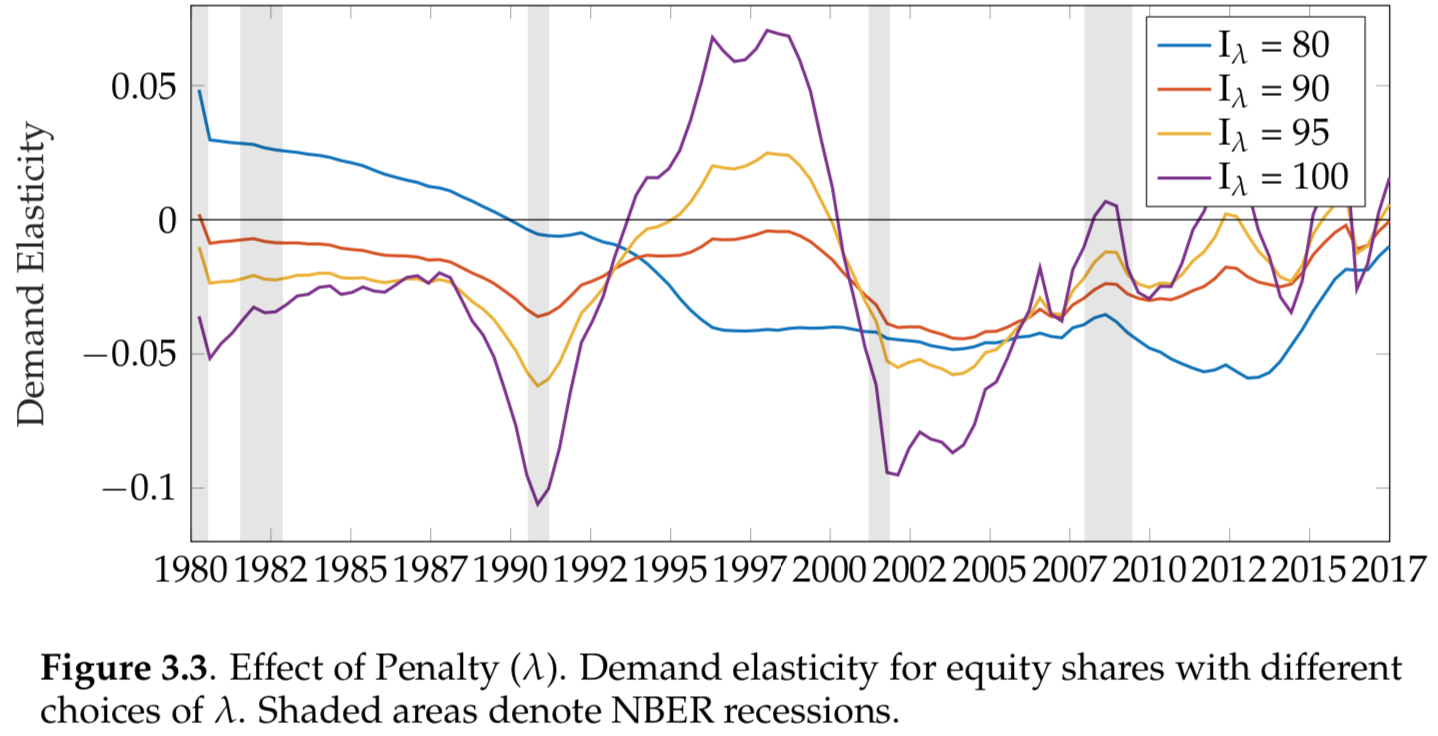

2. The elasticity of expectations and market instability

In this paper, I focus on the speculative positions of insitutional investors and their responsiveness to past returns. If asset price expectations become more responsive to price changes than to changes in fundamentals, a period of destabilizing speculation could arise, particularly when large institutional investors are involved. I measure the responsiveness of institutional investor’s equity positions to price changes when controlling for changes in fundamentals. Using a group-lasso approach, I estimate time-varying elasticities equity share demand on portfolio-level data and find procyclical changes in the investors’ responsiveness to price changes, which provides additional empirical support to the notion that speculation is destabilizing.

In this paper, I focus on the speculative positions of insitutional investors and their responsiveness to past returns. If asset price expectations become more responsive to price changes than to changes in fundamentals, a period of destabilizing speculation could arise, particularly when large institutional investors are involved. I measure the responsiveness of institutional investor’s equity positions to price changes when controlling for changes in fundamentals. Using a group-lasso approach, I estimate time-varying elasticities equity share demand on portfolio-level data and find procyclical changes in the investors’ responsiveness to price changes, which provides additional empirical support to the notion that speculation is destabilizing.

3. With Korkut Ertürk. Margin lending, monetary circulation, and asset price cycles

Existing literature shows structural changes in the relationship between monetary circulation and asset prices. We supplement this finding by showing that a cyclical relationship exists as well for multiple measures of monetary ciculation.

4. Heterogeneous market sentiment and regime-switching stock returns

Existing behavioral finance literature shows that speculation in financial markets can be destabilizing. In this paper, I provide further empirical evidence that speculation is destabilizing using a heterogeneous agent model with regime-switching returns.